does new hampshire have sales tax on cars

What states have the highest sales tax on new cars. I live in NH I bought my car in Massachusetts as it was considerably cheaper than in NH for the car I was looking for.

Nj Car Sales Tax Everything You Need To Know

New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states.

. But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Exact tax amount may vary for different items. Florida is the second cheapest state to buy a car and the state has a wonderful inventory.

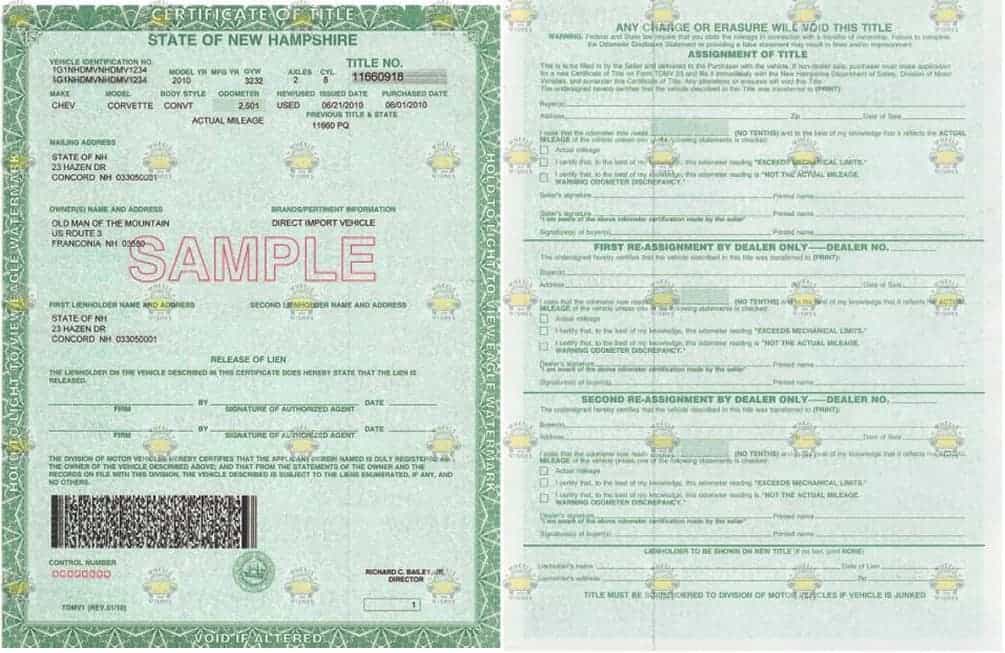

Only two states have higher average real estate property taxes than New Hampshire according to WalletHub but the state does a little better on the vehicle property tax front with an average. For more information on motor vehicle fees please contact the NH Department of Safety Division of Motor Vehicles 23 Hazen Drive. What confuses people is the property tax on cars based upon their book value.

Alaska Delaware Montana New Hampshire and Oregon dont impose any state sales taxes. There is no sales tax on anything in NH. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. Call the Audit Division at 603 230-5030 for additional assistance. Print a copy of that webpage and present it to any entity that requires confirmation that New Hampshire does not issue Certificates for Resale or Tax Exemptions.

The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. While states like North Carolina and Hawaii have lower sales tax rates below 5. If a vehicle sales tax applies the vehicle seller must collect the tax when the sale transaction occurs.

You need to come back to NH get. I did not pay any tax in MA. Unfortunately unless you register the car in the sales-tax-free state you will still have to pay the sales tax when you register the vehicle with your home states DMV.

There are however several specific taxes levied on particular services or products. If you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car. A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus.

New Hampshire EV Rebates Incentives. - Answered by a verified Tax Professional. Consumer Protection Bureau Office of the Attorney General 33.

The Granite States low tax burden is a result of. Only five states do not have statewide sales taxes. States like Montana New Hampshire Oregon and Delaware do not have any car sales tax.

As of 2020 while New Mexico charges sales tax on most goods it charges a lower tax on cars. New Hampshire is one of the few states with no statewide sales tax. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

However sales tax exemptions for vehicles arent necessary for New Hampshire since New Hampshire does not charge sales tax. Property taxes that vary by town. My neighbours who collect very expensive cars 1M do not.

Whether you have to pay sales tax on Internet purchases is a common question in a world where consumers buy everything from clothes to food to cars online. There are however several specific taxes levied on particular services or products. Most states have car sales tax exemptions especially for cars made before 1973 gifted vehicles and disabled owners.

No capital gains tax. While states like North Carolina and Hawaii have lower sales tax rates below 5. In fact the state is one of five states that do not have a sales tax.

1-888-468-4454 or 603 271-3641. Montana Alaska Delaware Oregon and New Hampshire. As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it.

The State of New Hampshire does not have an income tax on an individuals reported W-2 wages. You pay it every year and it declines to around 200 but thats it. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055 cents per megawatt-hour on electricity and a 7 tax.

States like Montana New Hampshire Oregon and Delaware do not have any car sales tax. But you cannot drive back to NH once you buy. We use cookies to give you the best possible experience on our website.

New Hampshire does not have sales tax on vehicle purchases. No there is no general sales tax on goods purchased in New Hampshire. New Hampshire is one of the few states with no statewide sales tax.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. No inheritance or estate taxes.

Does New Hampshire have a sales tax. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125. Any New Hampshire business contacted by a state or locality regarding the collection of sales or use tax is also encouraged to contact the DOJs Consumer Protection Bureau.

As of 2019 our research has found that five states have 0000 sales tax. Answer 1 of 6. When Sales Tax is Exempt in New Hampshire.

2022 New Hampshire state sales tax. New Hampshire does collect. But if you come from a neighboring state such as Maine or Vermont you just cant go to New Hampshire and just.

Does New Hampshire chage a sales tax when buying a used car. Alaska Delaware Montana New Hampshire and Oregon do not. Overall New Hampshire is the cheapest state to buy a car since registration fees are low and sales tax non-existent.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

Do You Need Car Insurance In New Hampshire

We Answer New Hampshire Vehicle Donation Questions

How To Sell A Car In New Hampshire The Dmv Rules For Sellers

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Kia Cue Concept Kia Cue Concept Design Auto Cars Teamkia Newhampshire Kia Concept Cars K Car

What S The Car Sales Tax In Each State Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

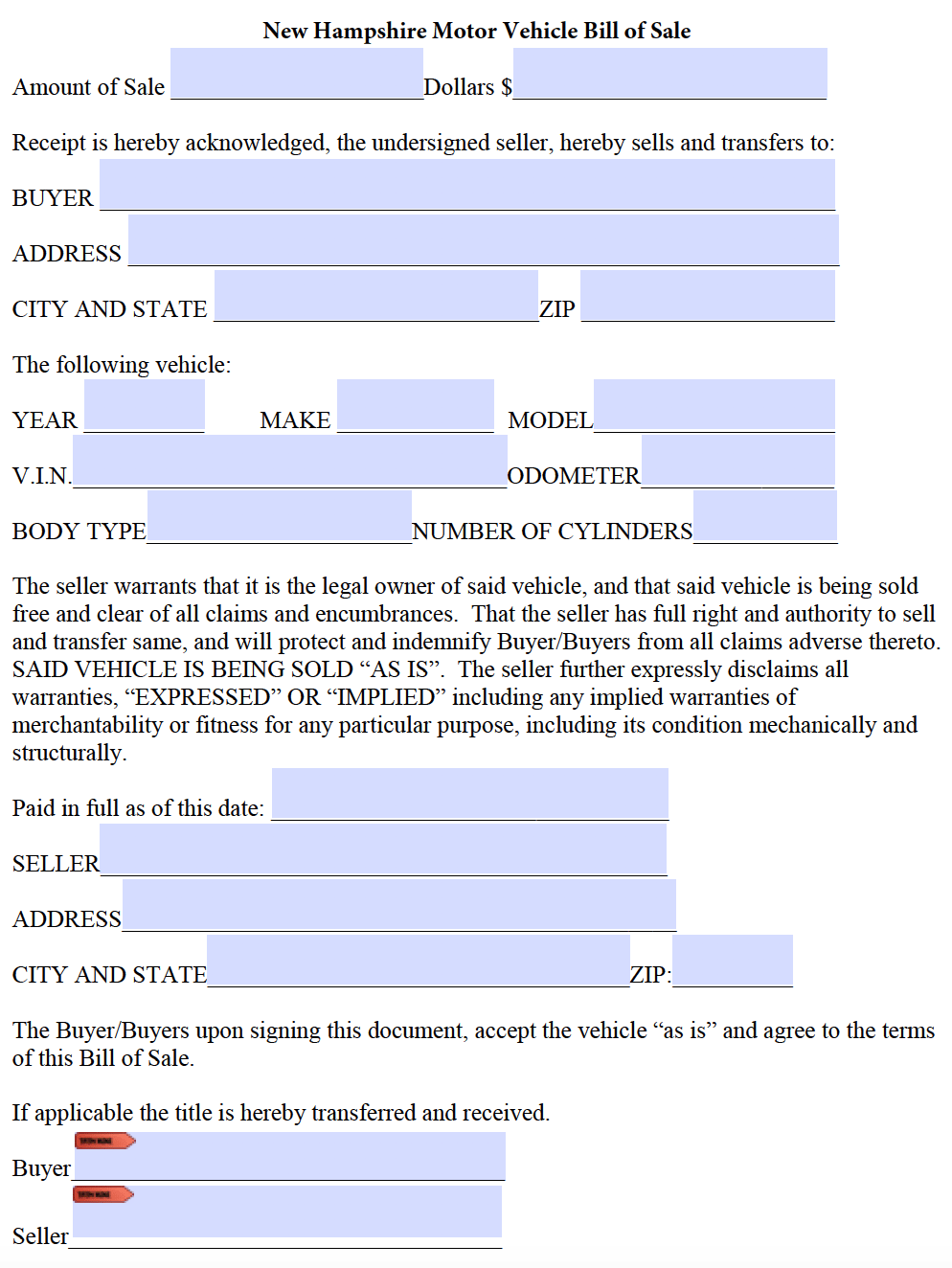

Free New Hampshire Bill Of Sale Forms Pdf

Mobil Kapolsek Tabrak Rumah Di Rembang 2 Orang Meninggal Mobil Orang Panther

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Dozens Of Cars Pileup In New Hampshire Just Over Massachusetts Border As Roads Turned Into An Ice Rink Christmas Morning

New Hampshire Motor Vehicle Dmv Power Of Attorney Power Of Attorney Form Power Of Attorney Power

1948 Mercury Woody Wagonfor Sale Listing Id Cc 874519 Classiccars Com Driveyourdream Mercury Woody Wagon Wagons For Sale Wagon

Australia New South Wales Qtu 368 Vintage Rare License Plate Ebay License Plate New South Wales New South

New Hampshire Bills Of Sale Facts To Know Templates To Use

Should You Be Charging Sales Tax On Your Online Store Income Tax Best Places To Live Filing Taxes